Let’s be honest, reading your personal auto policy can be time consuming and confusing. However, it’s important to understand what coverage is being afforded to you. The truth is that most auto insurance companies have key exclusions that eliminate coverage when you take your car on a race track. At Lockton Motorsports, we’re committed to making sure you have the protection you need, and thus, the following information is a basic personal auto policy guide.

For the purposes of this exercise, we are going to focus on two major sections of your personal auto policy :

- The declaration pages

- The exclusions

The Policy Declarations Page: The starting place for coverage specifics

An Insurance Declarations Page is located at the very front of your policy. It outlines the specific coverage and includes valuable information such as the policy period, policy limits, etc. The declarations page will also indicate where in the policy you can find exclusions related to your coverage. To find exclusions that would relate to physical damage of your auto, find the section titled “damage to your auto”–typically this will be “Part D” in a personal auto policy.

For most policies the sections will be laid out as follows:

- Part A – Liability Coverage

- Part B – Medical Payments Coverage

- Part C – Uninsured Motorist Coverage

- Part D – Coverage for Damage to your Auto

- Part E – Duties after an accident or loss

- Part F – General Provisions

Physical Damage Exclusions: What’s not covered when you suffer a loss to your vehicle?

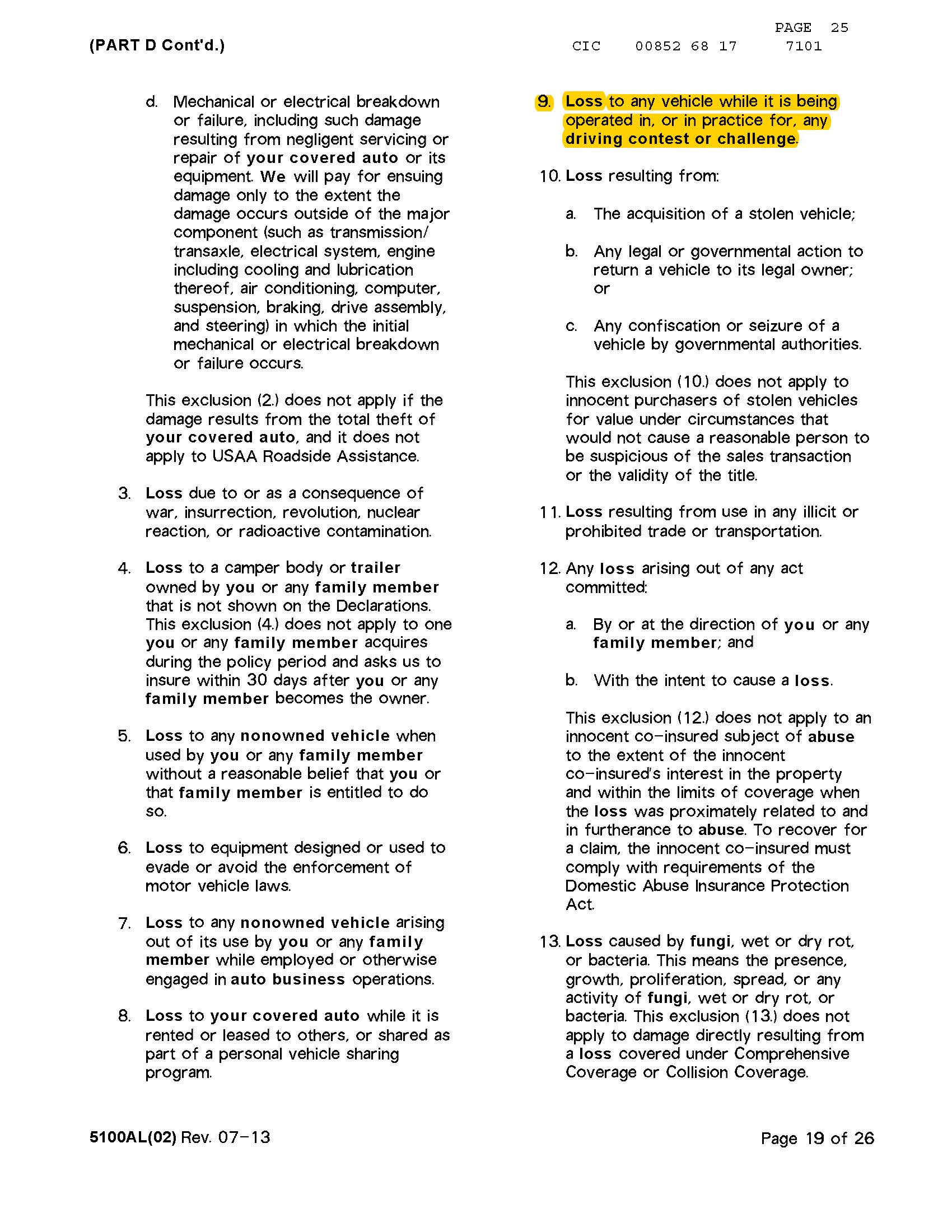

An exclusion in a policy is anything that is specifically not covered by your car insurance. To determine if physical damage to your vehicle is covered while participating in a HPDE event, start with the declarations page and locate Part D – Coverage for Damage to your Auto. Within this section, there will be a subsection titled “Exclusions”. The number of exclusions will vary from one insurance carrier to the next and can range from 8 – 20 different exclusions.

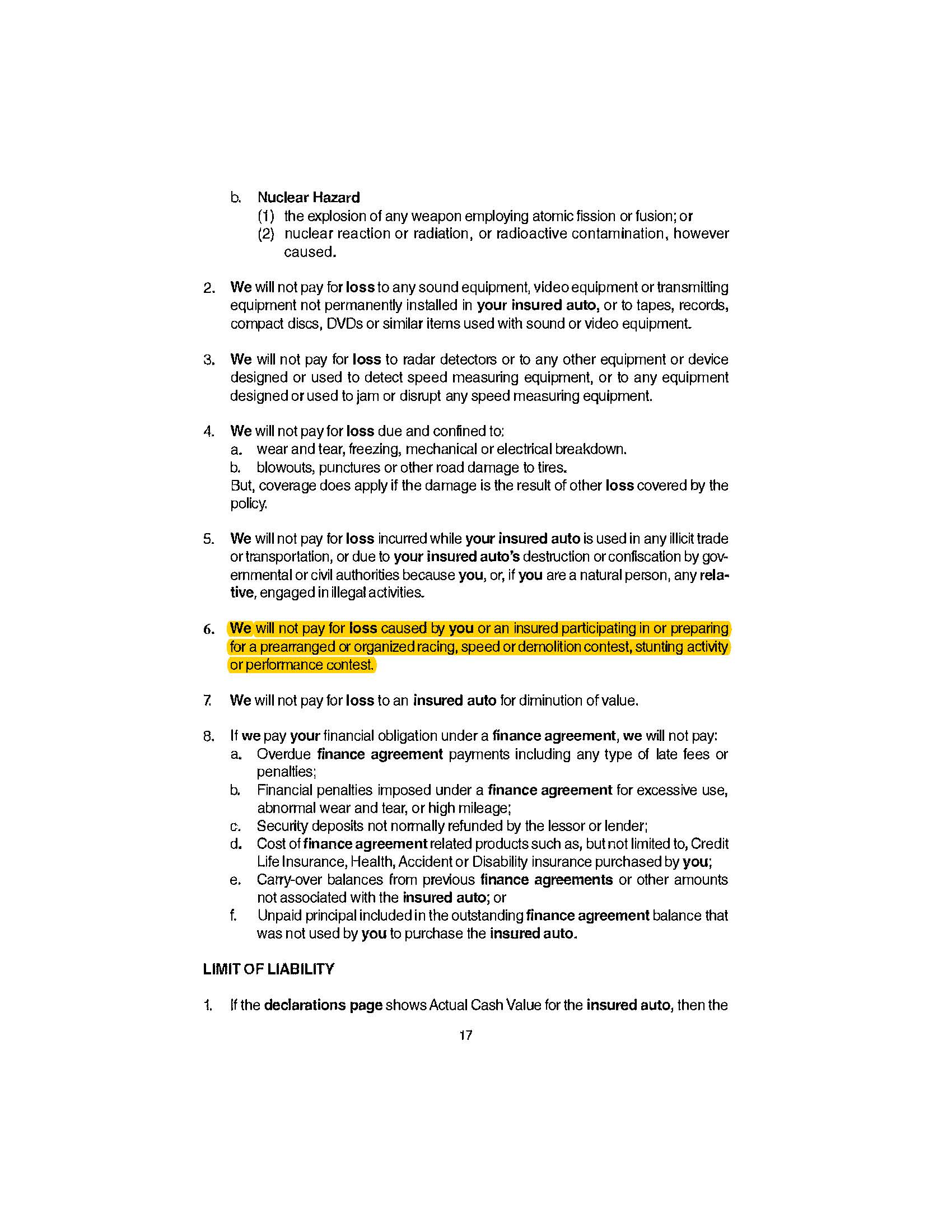

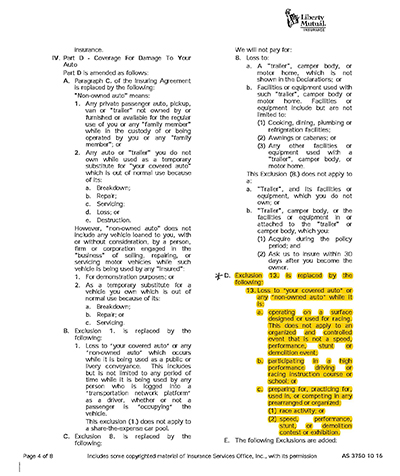

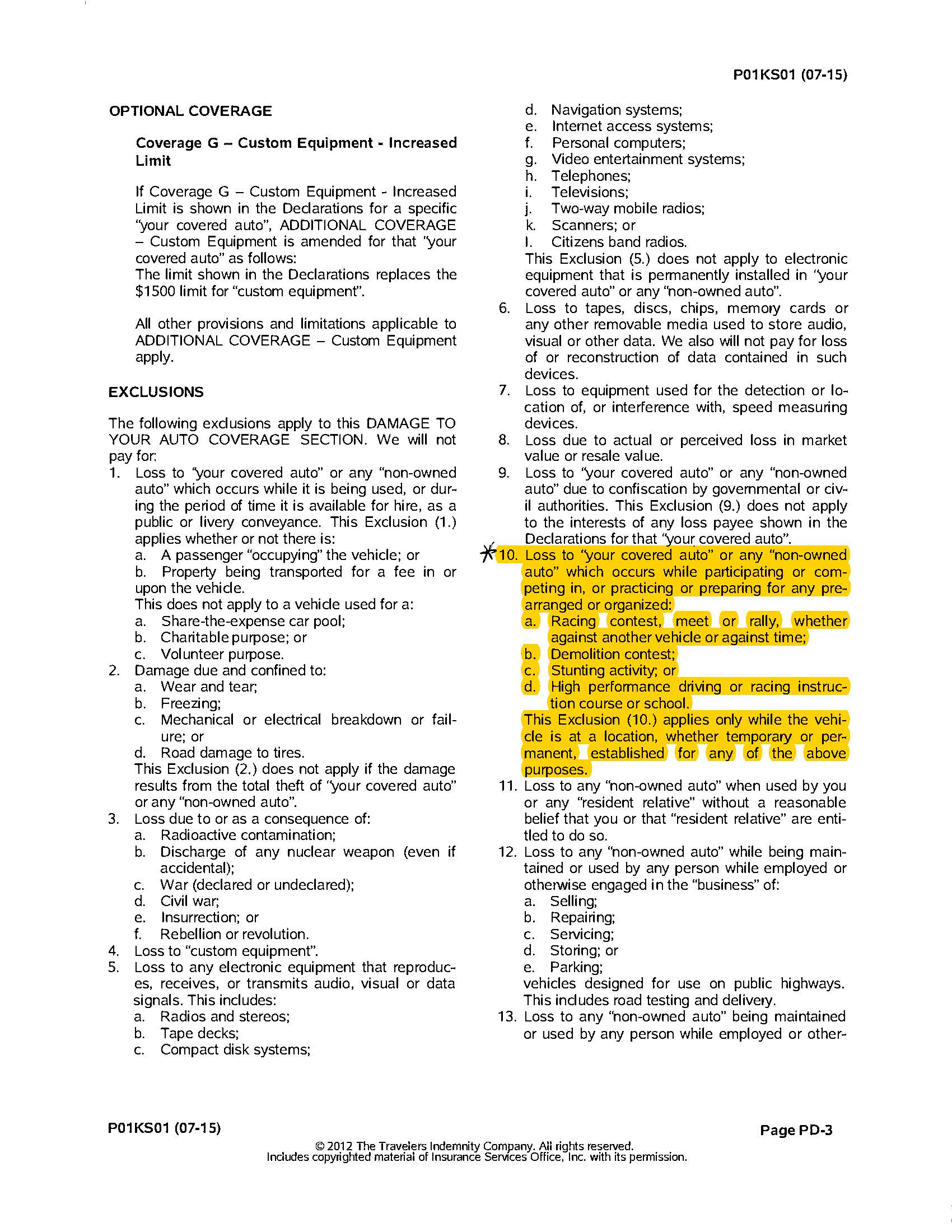

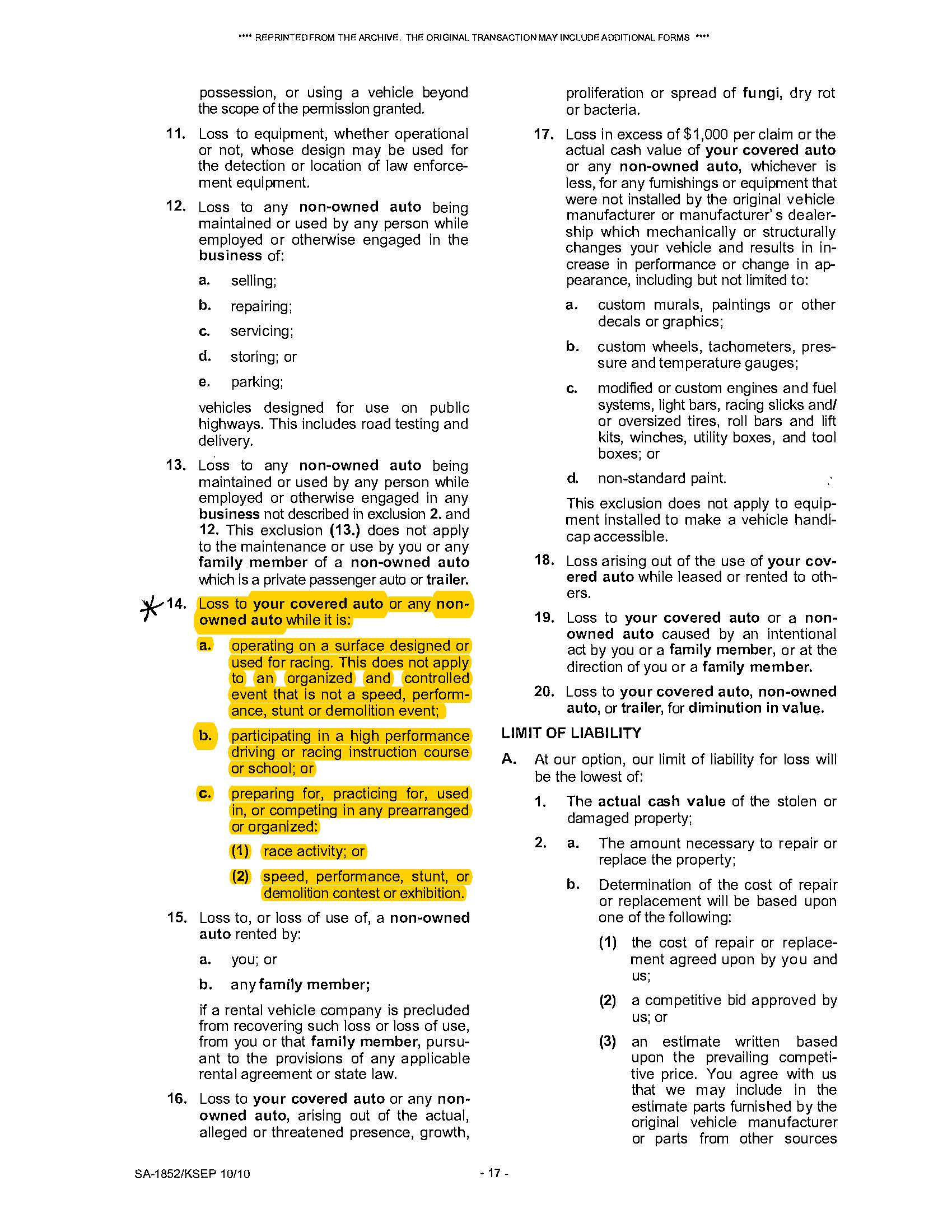

In most, if not all, personal auto policies you will find some type of exclusion that applies to damage done to your vehicle while you are participating in a high performance driving event. Some examples of the different types of language used are as follows:

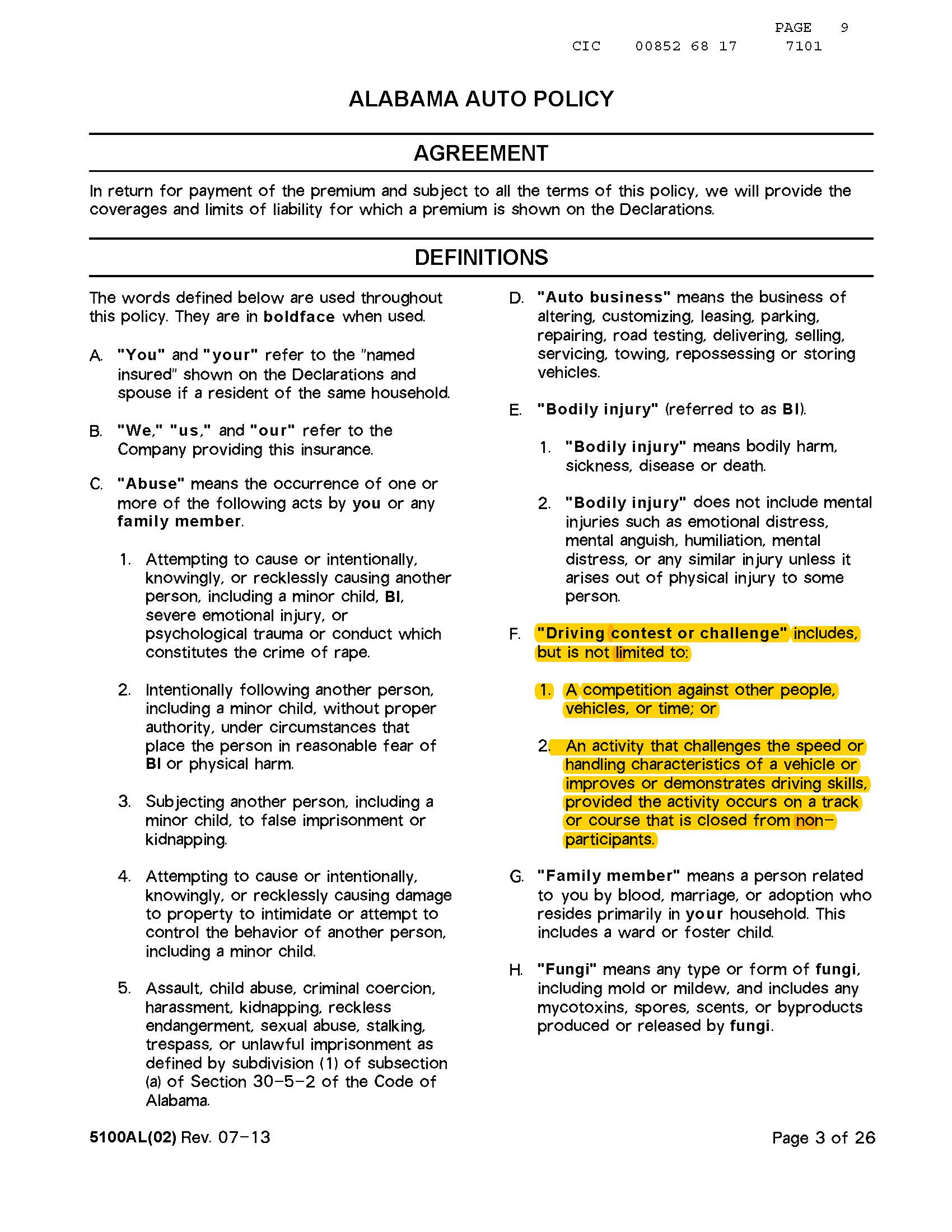

At first glance, if you read the following exclusion, most HPDE participants would understandably assume they are safe and their policy will provide coverage. After all, HPDE events are not driving contests or driving challenges—wheel-to-wheel racing is a driving contest or challenge.

But, insurance policies utilize defined terms—these are either included in bold font or in parentheses. Since “driving contest or challenge” is a defined term, you need to review the “definitions” section of the “insuring agreement”. Unfortunately, #2 is the definition of a HPDE event…therefore, coverage is excluded under this policy.

Note: if you have the ability to search your policy documents electronically, you can simply search the word “racing”. While HPDE is far from racing, the insurance carriers will generally lump these two categories into the same exclusion as it relates to uncovered damages to your vehicle.

There have been so many changes to auto insurance policies over the past ten years, and consequently it’s likely your personal auto policy excludes damage to your vehicle while participating in an HPDE event. Even if you think you’re covered based on feedback from your agent or research you conducted years ago, you should review your policy and contact your agent to make sure. Unfortunately, this is a process you should go through each year. Insurers have the right to change their policy terms and conditions (including exclusions) at every policy renewal.

If you find out that your personal auto policy excludes coverage, Lockton Motorsports offers both Single-Event policies for the occasional enthusiast, and Multi-Event policies for the avid HPDE participant that takes part in six or more events per year. Additionally, we have built our coverage knowing that many participants involved in HPDE events share their cars. As such we’ve built our coverage to include coverage for you, your instructor, and one additional driver. Please note, while there is no charge for the additional driver, for coverage to apply to you must list their name during the application process.

The bottom line is that insurance can be confusing. The good news is that we are here to help!

Have questions? Give our motorsports team a call at 866-582-4957.