“Always read the fine print” is good advice, especially when it comes to your personal auto policy. Ordinary car insurance covers your vehicle under a wide range of conditions, but it doesn’t cover everything. Quite often, a personal auto policy excludes coverage for HPDE, track days, time trials and other events where you take your car on a race track. Here’s a simple guide to personal auto policy exclusions you can use to check your coverage before your next track day event.

How do you check an auto policy for HPDE exclusions?

Let’s be honest, reading a personal auto policy can be time consuming and confusing. But to check your policy for HPDE exclusions, you really only need to check a few key sections of your policy:

- Declarations

- Exclusions

- Definitions

What are the declarations of an auto policy?

The declarations of an auto policy are a summary of your coverage and the starting place to look for coverage specifics.

The Insurance Declarations Page (or Dec Page) is located at the very front of your policy. It outlines coverage specifics, including valuable information such as the policy period, policy limits, etc.

The declarations page also indicates where in the policy you can find exclusions related to your coverage. For most policies the sections will be laid out as follows:

- Part A – Liability Coverage

- Part B – Medical Payments Coverage

- Part C – Uninsured Motorist Coverage

- Part D – Coverage for Damage to Your Auto

- Part E – Duties After an Accident or Loss

- Part F – General Provisions

To find exclusions related to the physical damage of your car, find the section titled “Damage to Your Auto” — typically this will be “Part D” in a personal auto policy.

What are the exclusions of an auto policy?

The physical damage exclusions tell you what’s not covered when you suffer a loss to your vehicle. An exclusion in a policy is anything that is specifically not covered by your car insurance.

To determine if physical damage to your vehicle is covered while participating in a HPDE event, start with the declarations page and locate “Part D – Coverage for Damage to your Auto.” Within this section, there will be a subsection titled Exclusions. The number of exclusions will vary from one insurance carrier to the next and can range from about 8–20 different exclusions.

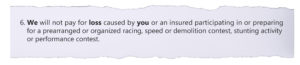

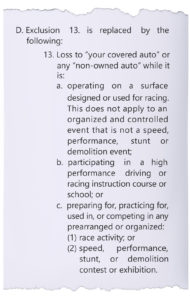

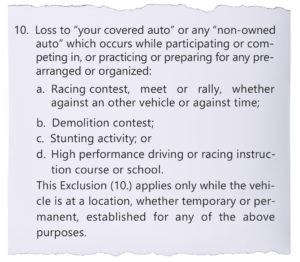

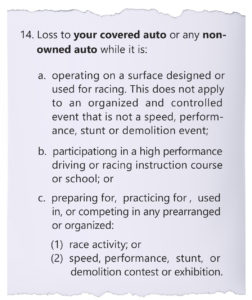

In most, if not all, personal auto policies you will find some type of exclusion that applies to damage done to your vehicle while you are participating in a high performance driving education event. Here are a few real auto policy exclusion examples showing the different types of language that are used:

- The first auto policy example excludes coverage while your covered auto is “operating on a surface designed or used for racing,” “participating in a high performance driving or racing instruction course or school,” and “preparing for, practicing for, used in, or competing in any prearranged or organized” event, specifically including a “race activity,” or “speed, performance, stunt, or demolition contest or exhibition.”

- The second auto policy example excludes a loss that occurs “while participating or competing in, or practicing or preparing for any pre-arranged or organized” event, specifically a “racing contest, meet or rally, whether against another vehicle or against time,” a “demolition contest,” a “stunting activity” or a “high performance driving or racing instruction course or school.”

- The third auto policy example excludes a loss to your covered auto while it is “operating on a surface designed or used for racing,” “participating in a high performance driving or racing instruction course or school,” or “preparing for, practicing for, used in, or competing in any prearranged or organized” event, specifically a “race activity” or a “speed, performance, stunt or demolition contest or exhibition.”

When do you need to check the auto policy definitions?

Most of the time, the policy declarations and the policy exclusions are clear enough that you can understand whether your activity or event is covered or excluded. But that’s not always the case.

At first glance, most HPDE participants would understandably assume a policy with the following exclusion language would still provide them with coverage in the event of a loss:

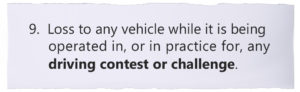

This example excludes a “loss to any vehicle while it is being operated in, or in practice for, any driving contest or challenge.”

It’s reasonable to believe you might still have coverage because HPDE events are not driving contests or driving challenges — it’s wheel-to-wheel racing that is a “driving contest or challenge.”

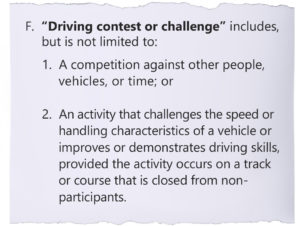

However, it’s important to note that insurance policies often define terminology contained in the policy. These terms are marked in either bold font or quotations.

Since “driving contest or challenge” appears in bold, it’s necessary to review the Definitions section of the “Insuring Agreement:”

Unfortunately, Section F(2) of the agreement is the definition of a HPDE event, so coverage for an HPDE event would be excluded under this policy.

Have you checked your auto policy for exclusions lately?

A lot has changed in the auto insurance industry over the last few years. Even if you’ve talked to your agent or checked your policy before, it’s probably time to check it again.

Insurers can make changes to their auto policy terms and conditions (including exclusions) at any policy renewal, and many do. Consequently, it’s likely your personal auto policy excludes damage to your vehicle while participating in an HPDE event.

If you have a paper copy of your policy documentation, you can check your policy using the process outlined above. If you have electronic policy documents, checking is even easier — just search for the word “racing.” True, HPDE is far from racing, but insurance carriers often lump these two categories together when it comes to exclusions.

If you do find your personal auto policy excludes coverage for HPDE, not to worry. Lockton Motorsports offers policies specifically designed to protect your car when you’re participating in HPDE, track day and time trial events. Coverage includes:

- Street-legal cars and non-licensed track cars.

- Modifications you’ve made to your car.

- Two drivers at each event at no additional cost.

- Any demonstration laps your instructor drives.

Along with HPDE Insurance, we also offer Off-Track Insurance to protect your track car when it’s not on the track, Auto-Cross with Off-Track Insurance for autocross enthusiasts, and more.

Get coverage fast at LocktonMotorsports.com or call (866) 582-4957 to speak to our motorsports insurance experts.